The Digital Twin of Your Revenue Operation

See exactly where revenue slows down between

the first sale and collected cash.

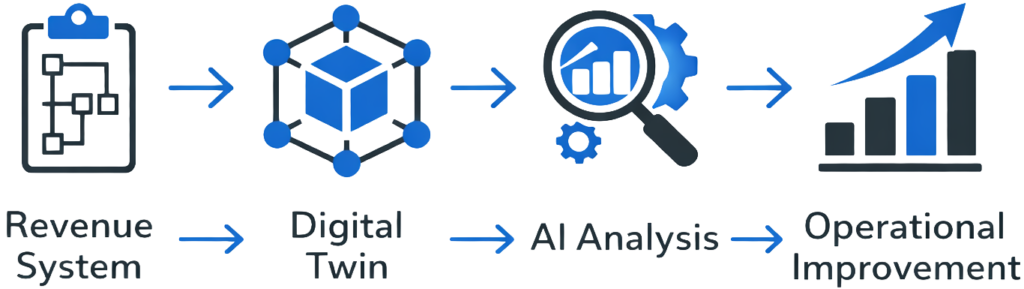

Lead2Cash builds a digital twin of your revenue system so your team and AI can model how your business actually turns sales into cash. Most tools analyze the data your systems produce. Lead2Cash models the system that produces that data. The model comes first. The improvements come from the model.

Most Companies Cannot See the System That Produces Revenues

Revenue moves through a chain of steps:

Lead > Opportunity > Contract > Delivery > Billing Collections > Payment

When that system breaks, the symptoms appear everywhere. Sales blames delivery. Delivery blames billing. Billing blames customers. But the real problem is simpler. The process was never modeled. If you cannot see the system, you cannot fix it. Lead2Cash makes the system visible.

A Digital Twin of Your Revenue Operation

Lead2Cash builds a model of how your business turns sales into cash.

Your team and AI work on a shared canvas that represents the structure of your revenue system:

- departments involved in each deal

- handoffs between teams

- tools and software used

- time spent in each stage

- labor and operational cost

The visual map is not the product. The operational model behind it is. Once the model exists, the system can identify delays, bottlenecks, and hidden operational costs.

1. Model the revenue system

Your lead-to-cash operation is modeled from first sales conversation to collected payment. Departments, tools, timelines, and handoffs become part of a connected operational model.

2. Analyze the structure

AI and practitioners analyze the model to identify:

- delays between departments

- hidden labor cost

- tool stack friction

- structural bottlenecks

3. Improve the system

Insights from the model generate a prioritized improvement plan that accelerates the cash conversion cycle.

For most companies, the Lead2Cash model produces insights they have never seen clearly before.

Examples include:

- full cash conversion cycle broken down by department

- total cost of the revenue operation

- cost to close and collect a deal

- tool stack redundancy or integration gaps

- delays caused by ownership or handoff issues

Instead of guessing where the problem is, you can see it.

Sentry Trade has been working inside growth-stage companies since 1996. Accounting. Finance. Operations. HR. The full back office. We built Lead2Cash because we repeatedly saw the same failure pattern:

Solutions arriving before anyone had taken the time to understand the system they were supposed to fix.

Lead2Cash ensures that understanding happens first. Our practitioners work alongside your team inside the platform to implement improvements revealed by the model. Lead2Cash is designed for growth-stage companies typically between $5M and $50M in revenue. Common industries include: construction, manufacturing, professional services, SaaS, ecommerce, facility services, private equity portfolio companies

These companies share one trait: Growth created operational complexity faster than the back office could keep up.

Growth Gets Messy.

We Bring Clarity.

Whether you need one service or the whole back office, we’ll start by understanding your business not pitching you a package.